Simple, Transparent Pricing

Always know what you’ll pay.

What is a transaction?

- Order imported into TaxJar with one or more line items

- SmartCalcs API sales tax calculation or rate lookup

1K

5K

10K

Over 10,000 Transactions? Call Us at 1-855-800-6681 Contact us

TaxJar Basic Plans Include

- Automatic sync with your shopping carts and eCommerce channels

- Return-ready sales tax reports for every state

- State and local level sales tax reports

- Upload additional data via CSV

- Access to enroll in AutoFile to automate your sales tax filings in any state

- Support for your shipping taxability in different states

- Support for both origin-based and destination-based sales tax sourcing

- Detection of sales tax over-collection or under-collection

- Helpful and amazingly fast response times from our TaxJar Success Team

When I started my business, there were just a handful of things that I thought I might not be able to do, and one of them was sales tax. I felt like I was staring up the White Cliffs of Dover, and TaxJar came up in a turbocharged helicopter, lifted me up and I was on my way.Brian Nash, TunersCare.com

Common Questions

Feel free to contact us if you can't find the answer to your question. We're happy to help you.

TaxJar offers automated sales tax reporting and filing for multi-channel online sellers. Connect the online shopping carts and/or marketplaces where you sell just one time and we’ll download the data and prepare it so you can easily file sales tax returns in the states you have nexus.

We also offer the AutoFile feature which automatically files your returns on your behalf.

Platforms like Amazon, eBay and Shopify help you collect sales tax, but that’s it. They don’t help you with reporting or filing. That’s where TaxJar will save you hours of effort each month, quarter or year depending on how often you are required to file.

That’s okay. Lots of TaxJar customers have CPAs. In fact, their CPAs find TaxJar’s reporting to be super helpful and save a bunch of time when it’s time to file sales tax returns.

No way. No contracts. No setup fees. No cancellation fees.

If you go over your transaction limit during a single month, we will charge you the difference between the TaxJar plan you’re on and the price of the plan that matches your transaction volume for the month when the overage occurred.

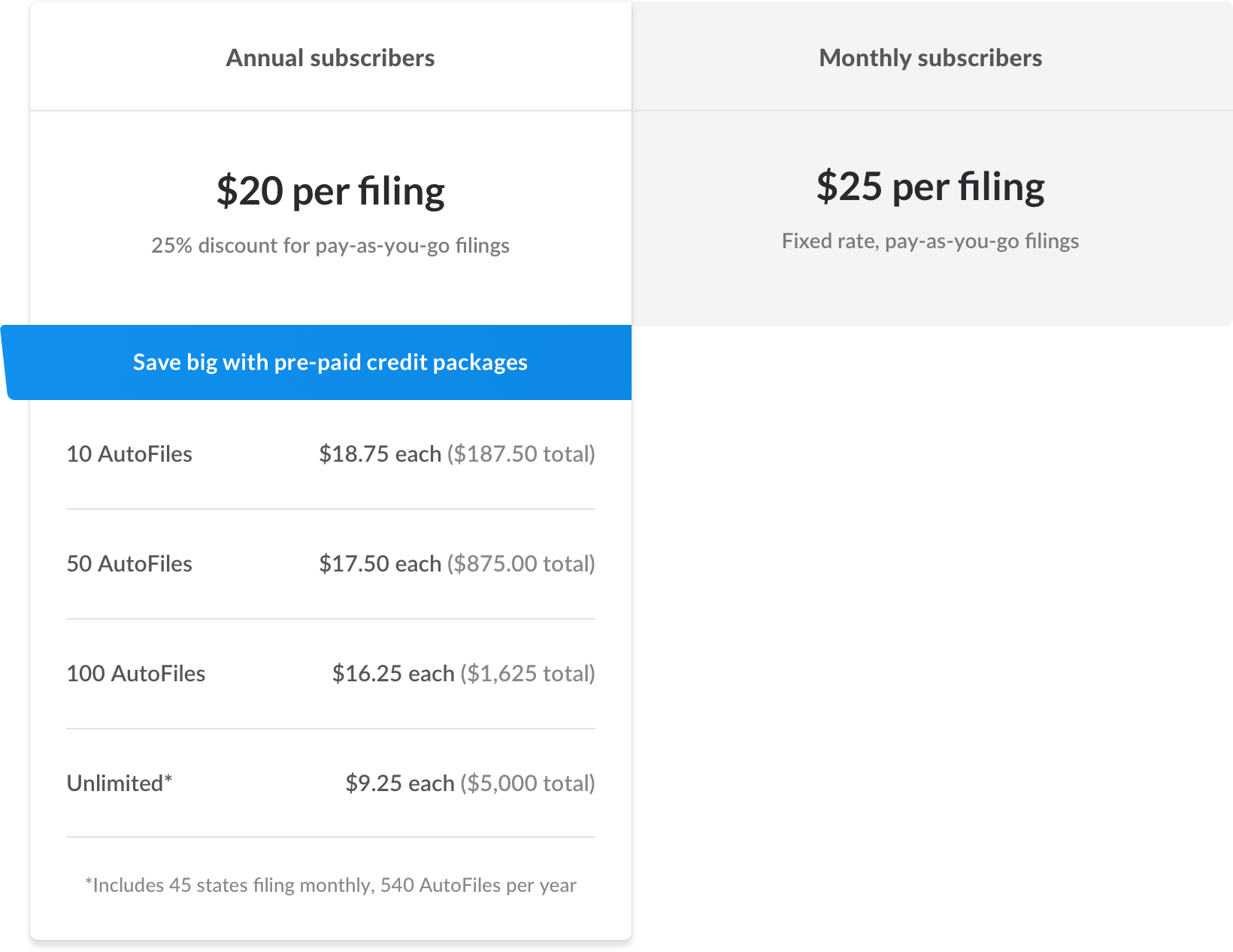

No. AutoFile is an additional fee and is charged any time we file a sales tax return for you.